Money might not be recognized as an essential commodity to survive by governments all over the globe, but no one can refute the point, that it sure is the backbone of any economy. And so, in order to keep the economy functional in any country, it is necessary that there is lending and borrowing of the funds.

Now up until now, banks were majorly responsible for managing this borrowing and lending of funds, but today there are other possible options as well. One such option is P2P lending. But how reliable is this option? What does it exactly mean? Interested in finding these answers? Well, then come, let’s begin!

What is P2P lending?

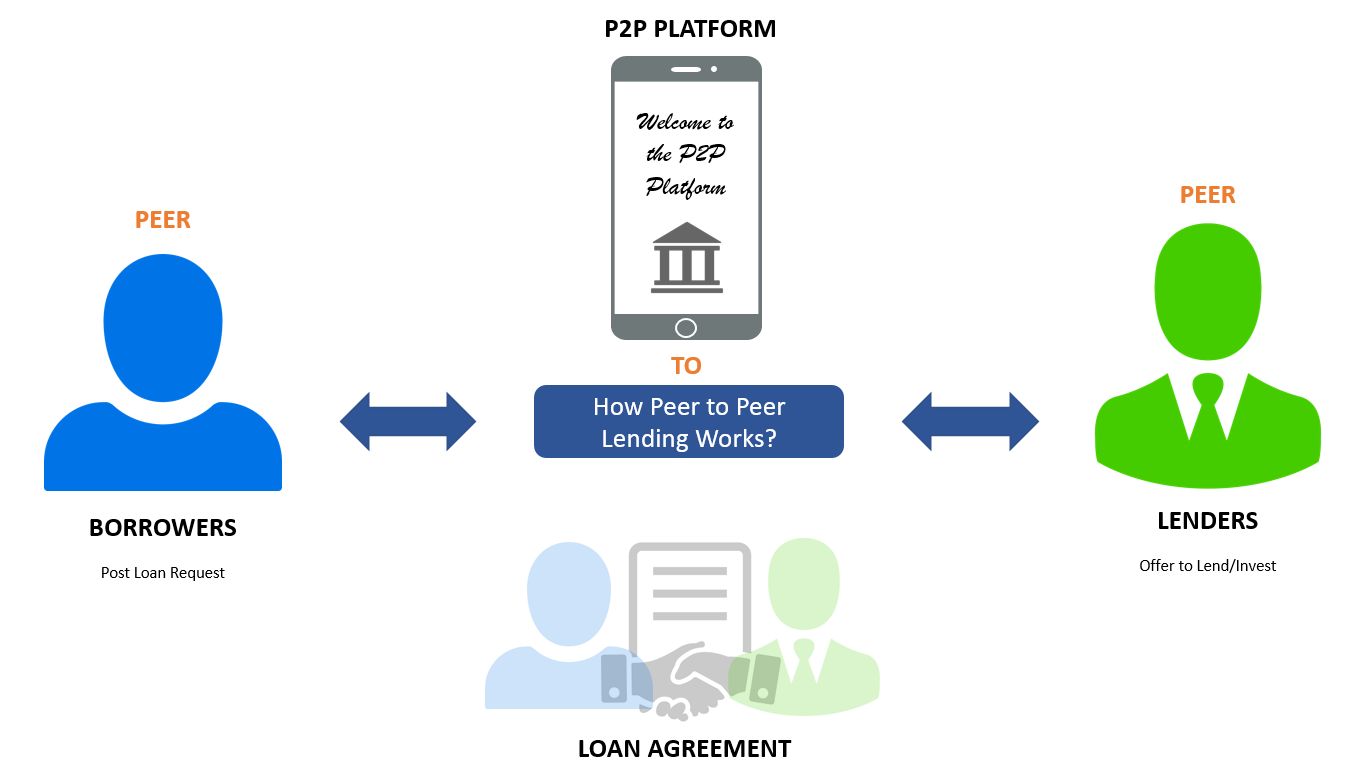

P2P lending or peer-to-peer lending is a comparatively new practice that involves lending money to individuals or businesses through online services where lenders are matched to receivers. One plus point of using this service is that it operates on lower overhead costs, as a result, its services are cheaper than those of financial institutions.

This benefits both the lenders and the borrowers as now the borrowers can take up loans on cheaper interest rates while the lenders can earn more money as compared to what they would have earned, provided they invested in savings or investment services offered by the banks and other institutions.

The peer to peer platform was first introduced in the UK in 2005 and one year later in the US in 2006. Now, a decade over, it has grown and leveled the lending landscape for both the borrowers and receivers. Some examples of peer-to-peer lending platforms are Funding Circle, Zopa, Lending Club, RateSetter, etc.

Why is it successful?

There is a myriad of reasons as to why this alternative platform that allows the borrowers and lenders to skip the financial intermediary is a success. Here are some of those reasons-

- Lower interest rates than credit cards

One important reason because of which the P2P lending is registering incredible growth is because the lending rates at this platform are significantly lower than what credit cards offer.

- Delinquency rates are lower

In P2P loans the delinquency rates are lower as compared to the traditional loans. Between 2010 and 2014 it has been recorded that that 3.2% of the P2P loans were past due while for traditional loans this percentage is 3.7%.

- P2P offers a quick process

In order to get the loans sanctioned from the banks, certain documents have to be arranged and one has to make several rounds of banks. But with P2P lending, this problem can be solved. With online services, one can pace-up the process.

- Offers personalized lending

Many lenders like to know, who they are lending sums to and for what reasons. This gives them a personalized feel and a sense of greater satisfaction. And P2P lending makes this possible. Also, it opens up a way for the lenders to check and only then choose a borrower. Hence, the lender gets to make a decision only after ascertaining that he will get his money back.

Thus, P2P or peer-to-peer is a relatively new alternate platform for connecting the borrowers and lenders. This platform has in a short time gained worldwide popularity and still, it is growing at a fast pace!